Market Overview:

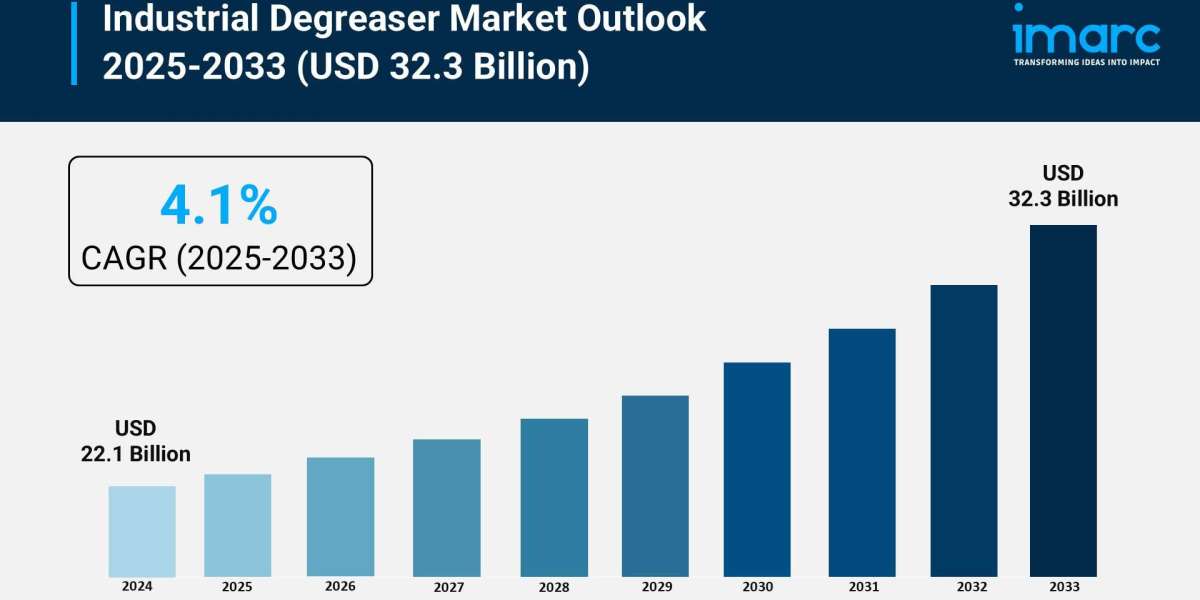

The industrial degreaser market is experiencing rapid growth, driven by stringent environmental and safety regulations, expansion of global automotive production, and rising industrialization in emerging economies. According to IMARC Group’s latest research publication, “Industrial Degreaser Market Report by Type (Water-Based, Solvent-Based), Grade (Liquid-Based, Petroleum Based, Bio-Based, and Others), Application (Automotive, Manufacturing, Pharmaceutical, Aviation, and Others), and Region 2025-2033”, the global industrial degreaser market size reached USD 22.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/industrial-degreaser-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Industrial Degreaser Market

- Stringent Environmental and Safety Regulations

The global industrial degreaser market is experiencing a significant shift due to rigorous environmental mandates that restrict the use of hazardous chemicals. Agencies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) through REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) have established strict limits on volatile organic compounds (VOCs). These regulations are compelling manufacturers to transition away from traditional chlorinated and petroleum-based solvents. For instance, the EPA’s "Safer Choice" program has incentivized the production of non-toxic, biodegradable cleaning agents. Currently, the water-based degreaser segment dominates the landscape, valued at over $23.48 billion, as companies seek to avoid the legal and financial penalties associated with chemical non-compliance. These legislative frameworks not only prioritize worker safety by reducing exposure to carcinogens but also address wastewater treatment constraints, forcing industrial operators to adopt sustainable, low-impact degreasing technologies in their daily maintenance workflows.

- Expansion of Global Automotive Production

The automotive sector remains a primary engine for degreaser demand, utilizing these chemicals for the intensive cleaning and maintenance of engines, gearboxes, and precision parts. Global vehicle production has recently reached significant volumes, with approximately 85.4 million motor vehicles produced annually, representing a year-over-year increase of roughly 5.7%. This surge in manufacturing activities necessitates high-performance degreasers to remove lubricants, cutting fluids, and corrosion inhibitors during assembly. Furthermore, the automotive aftermarket is a substantial contributor, as maintenance services increasingly adopt periodic cleaning to enhance fuel efficiency and engine longevity. Industry leaders like MG Motor India have integrated specialized degreasing pre-treatment chemicals, such as PPG Asian Paints’ liquid alkaline solutions, into their production lines. These initiatives are not only aimed at operational efficiency but also at environmental sustainability, with such shifts in pre-treatment chemicals estimated to reduce annual carbon dioxide emissions by nearly 787 tons at specific manufacturing sites.

- Rising Industrialization in Emerging Economies

Rapid industrial development across the Asia-Pacific and Middle East regions is creating a massive requirement for industrial cleaning solutions to maintain new infrastructure and machinery. In India, government initiatives like the "Make in India" program and the Production-Linked Incentive (PLI) scheme for specialty steel and automobiles have spurred the creation of new factories and industrial corridors. For example, the Indian government recently approved twelve new project proposals under the National Industrial Corridor Development Programme with an estimated investment of $3.4 billion. Similarly, Saudi Arabia’s "Vision 2030" is driving large-scale manufacturing and logistics projects that require high-performance degreasers to meet international hygiene standards. This regional expansion is supported by the availability of cost-effective labor and raw materials, leading major global manufacturers to relocate production bases to these areas. Consequently, the increased density of manufacturing plants and power utility units in these developing markets is fueling a continuous need for bulk degreasing agents to ensure peak equipment performance.

Key Trends in the Industrial Degreaser Market

- Surge in Bio-Based and Green Chemistry Solutions

A prominent trend in the industrial degreaser market is the transition toward bio-based formulations derived from renewable resources like plant oils, citrus extracts, and enzymes. These "green" degreasers are gaining traction as companies strive to meet corporate Environmental, Social, and Governance (ESG) goals. Unlike petroleum-based alternatives, bio-based products are non-flammable and do not emit harmful gases, making them safer for both the environment and the workforce. For example, over 60% of regional producers in certain high-regulation markets have already shifted from traditional solvents to citrus-derived or glycol ether alternatives. Major chemical players are heavily investing in research and development to create these plant-based surfactants that maintain high cleaning efficacy without the ecological footprint. This trend is further supported by the introduction of ready-to-use gel formulations, such as those used in food processing to remove stubborn, carbonized soils, which combine high performance with environmental safety.

- Integration of IoT and Automated Dosing Systems

The adoption of "Smart Cleaning" is transforming how degreasers are used in large-scale facilities through the integration of the Internet of Things (IoT) and automated dispensing technology. Modern industrial cleaning systems now feature sensor-integrated dosing units that monitor chemical concentration, contamination levels, and cycle efficiency in real-time. This digital shift allows operators to optimize chemical consumption, significantly reducing waste and ensuring consistent performance across assembly lines. These intelligent systems facilitate predictive maintenance by identifying when machinery requires degreasing before performance degrades, thereby minimizing unplanned downtime. Companies like Ecolab and BASF are at the forefront of this trend, providing not only the chemical solutions but also the specialized equipment and technical support needed for Clean-In-Place (CIP) operations. By leveraging real-time analytics, manufacturers can achieve precise regulatory compliance and operational transparency that was previously unattainable with manual application methods.

- Development of High-Purity and Rapid-Evaporation Solvents

In precision-heavy industries like electronics, aerospace, and medical device manufacturing, there is an emerging trend toward high-purity hydrocarbon and alcohol-based degreasers. These specialized formulations are designed to leave zero residue on sensitive surfaces, which is critical for components that undergo subsequent coating or assembly processes. A key innovation in this space is the "rapid evaporation" feature, which allows surfaces to dry almost instantly, accelerating the production cycle. For instance, recent product launches such as SLIPCLEAN RD utilize highly purified solvents to eliminate industrial residues like semi-cured adhesives and carbon deposits while ensuring the treated parts are ready for immediate use. This trend reflects a broader move toward "industry-specific customization," where degreasers are no longer viewed as commodity products but as engineered chemicals tailored to the specific thermal and material requirements of high-tech manufacturing environments, effectively balancing cleaning power with material compatibility.

Leading Companies Operating in the Industrial Degreaser Industry:

- 3M Company

- Abro Industries Inc.

- BG Products Inc.

- Callington Haven Pty Ltd.

- Carroll Company (FGL Group)

- Claire-Sprayway Inc. (Plaze Inc.)

- Dow Inc.

- Nyco Products Company

- Oil Technics Ltd

- Stepan Company

- Superior Industries Inc.

- Valvoline Inc.

Industrial Degreaser Market Report Segmentation:

By Type:

- Water-Based

- Solvent-Based

By Grade:

- Liquid-Based

- Petroleum Based

- Bio-Based

- Others

By Application:

- Automotive

- Manufacturing

- Pharmaceutical

- Aviation

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302