The global fiber-based blister pack market is entering a decade of rapid transformation, driven by sustainability priorities, strict regulatory measures on plastic usage, and rising adoption across pharmaceuticals, personal care, electronics, and FMCG packaging.

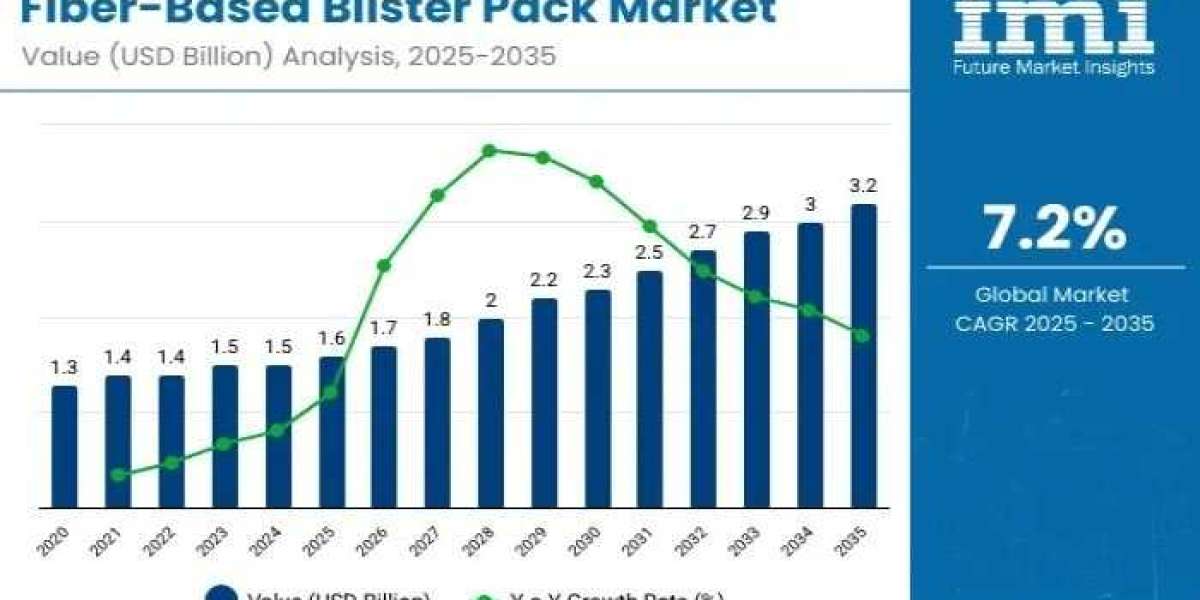

According to the latest market assessment, the industry is projected to grow from USD 1.6 billion in 2025 to USD 3.2 billion by 2035, marking a 100% total expansion and achieving a CAGR of 7.2%. Over the next ten years, the market is set to double in size, reinforcing fiber-based blister packs as a mainstream alternative to conventional plastic formats.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates –https://www.futuremarketinsights.com/reports/sample/rep-gb-25083

A Decade of Accelerated Growth Toward Fiber Packaging

The market is evolving in two distinct phases.

Between 2025 and 2030, revenues rise from USD 1.6 billion to USD 2.2 billion, accounting for 37.5% of decade-long growth. This period is shaped by strong uptake in pharmaceuticals and personal care, sectors that are rapidly transitioning to recyclable and biodegradable packaging. Regulatory mandates promoting reduced plastic consumption and circular economy compliance further strengthen early adoption.

The 2030–2035 period marks the faster growth stage, contributing 62.5% of total expansion as advanced molded fiber technology, barrier coatings, and improved sealing systems gain momentum. Applications expand into food, electronics, and premium consumer goods as fiber-based blister packs offer enhanced durability, printability, and automated production compatibility.

Quick Stats: Fiber-Based Blister Pack Market (2025–2035)

- Market Value (2025): USD 1.6 billion

- Market Forecast Value (2035): USD 3.2 billion

- Market Forecast CAGR: 7.2%

- Leading Segment (2025): Clamshell blisters – 41.2% market share

- Top Growth Region: Asia-Pacific (China leads with 7.9% CAGR)

- Key Players: Huhtamaki, PAPACKS, TOPPAN Packaging Solutions, Rohrer Corporation, Keystone Folding Box Co., Smurfit WestRock, Ecobliss, Locked4Kids, Karl Knauer, Colbert Packaging

Sustainability is Reshaping the Competitive Landscape

From 2020 to 2024, the market expanded from USD 1.2 billion to USD 1.5 billion, largely driven by regulatory pressure to replace traditional plastics with biodegradable packaging. Approximately 70% of revenues during this period came from OEMs and converters developing molded fiber and recyclable paperboard structures.

Industry leaders such as Huhtamaki, Stora Enso, Sonoco, and Smurfit WestRock focused on barrier innovations, sealing compatibility, and material strength to meet stringent pharmaceutical and food-grade requirements. Meanwhile, emerging players like PaperFoam, PulPac, and Ecobliss are gaining share through modular, fully recyclable blister systems that offer enhanced machinability and reduced carbon footprint.

By 2035, recyclable and bio-coated fiber blister solutions are expected to account for 40%+ of total market value. Competitive differentiation will focus on compostable coatings, nanocellulose barriers, automation-ready designs, and digital traceability features supporting global compliance.

What Is Driving Market Growth?

The surge in global demand for eco-friendly, recyclable packaging is the primary growth driver. Fiber-based blister packs enable manufacturers to significantly reduce plastic dependency while maintaining product integrity, tamper resistance, and branding visibility.

Key factors include:

- Global plastic reduction mandates by governments and environmental agencies

- Rising consumer preference for sustainable packaging

- Expanding pharmaceutical and healthcare demand for child-resistant and tamper-evident formats

- Improved automation compatibility, reducing production costs

- Lightweight designs lowering logistics and transportation emissions

Fiber packaging’s ability to integrate high-quality graphics, specialty coatings, and protective structures strengthens its adoption across premium and mass-market product categories.

Segmental Highlights in the Fiber-Based Blister Pack Market

By Material – Paperboard Leads the Market

Paperboard represents 38.6% of market share in 2025 due to its recyclability, cost efficiency, and compatibility with existing blister machinery. The material is favored across pharmaceuticals, personal care, and consumer goods.

By Blister Type – Clamshell Blisters Dominate

With 41.2% share, clamshell blisters remain the top choice for consumer electronics, healthcare, and retail packaging. Their strong visibility and enhanced protection drive widespread preference.

By Closure Type – Heat-Sealed Blisters Stay Ahead

Heat-sealed blisters hold 44.5% market share due to strong barrier performance, tamper evidence, and suitability for food and healthcare products.

By Application – Pharmaceuticals Lead the Way

Pharmaceutical packaging accounts for 39.8% share in 2025, driven by strict safety, compliance, and sustainability requirements.

By End-Use – Healthcare Tops Adoption

Pharmaceuticals and healthcare make up 42.7% of total demand in 2025, solidifying the sector as the anchor of long-term growth.

Regional Country-Level Outlook

United States – CAGR 7.5%

Driven by FDA-aligned sustainability initiatives, pharma companies and food brands are rapidly shifting to high-barrier fiber blister solutions.

Germany – CAGR 7.2%

The EU Green Deal and strict recyclability mandates propel adoption across pharmaceuticals, consumer goods, and premium food sectors.

United Kingdom – CAGR 7.1%

SMEs and large brands alike adopt fiber blister packaging to meet waste-reduction policies and rising consumer expectations.

China – Fastest-Growing Market at 7.9% CAGR

China’s government-led plastic reduction laws, combined with booming FMCG and pharmaceutical sectors, position it as a global adoption leader.

India – CAGR 7.8%

India’s pharmaceutical export sector and plastic reduction initiatives fuel rapid market expansion.

Japan – CAGR 7.0%

Paperboard dominates (39.4%) as Japan prioritizes sustainable, precise, high-performance packaging for electronics and healthcare.

South Korea – CAGR 7.2%

Clamshell blisters lead (40.3%) driven by strong demand from electronics, K-beauty, and premium retail.

Competitive Landscape

The fiber-based blister pack market remains moderately fragmented, comprising global giants, regional players, and sustainability-focused innovators. Leading companies—Huhtamaki, PAPACKS, TOPPAN, Keystone, WestRock, Ecobliss—are investing in advanced fiber molding, recyclable coatings, premium printing, and automation-compatible equipment.

Emerging players are innovating in lightweight engineering, compostable barrier films, and scalable modular blister designs, intensifying competition across global supply chains.

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.