Printing of tax forms accurately is a matter of great concern for any business owner, and QuickBooks Desktop makes this task easier. Are you searching for a trusted guide to Print Form 1099 and 1096 in QuickBooks Desktop? This step-by-step guide ensures that you will be able to prepare your tax forms without any errors. You can even contact our support team at +1 (866) 500-0076 for instant help.

QuickBooks Desktop makes it very easy to manage your vendor payments and then generate the required tax forms: 1099 and 1096. Whether you are printing 1099 forms for contractors or compiling the summary form 1096 for the IRS, this guide will walk you through the entire process.

Learn the easiest way to print your form 1099 and 1096 in QuickBooks Desktop and ensure accurate tax reporting.

Step 1: Prepare Your QuickBooks Desktop for 1099 Forms

Ensure that your QuickBooks Desktop is updated and your vendor information is complete before you start printing. Proceed as follows:

- Go to Edit Preferences.

- Select Tax: 1099 and click Company Preferences.

- Verify that the vendors' information is correctly updated, such as TIN and payment amounts.

This is important preparation because QuickBooks uses this data to print the 1099 forms correctly. Any missing information may lead to errors or IRS rejections.

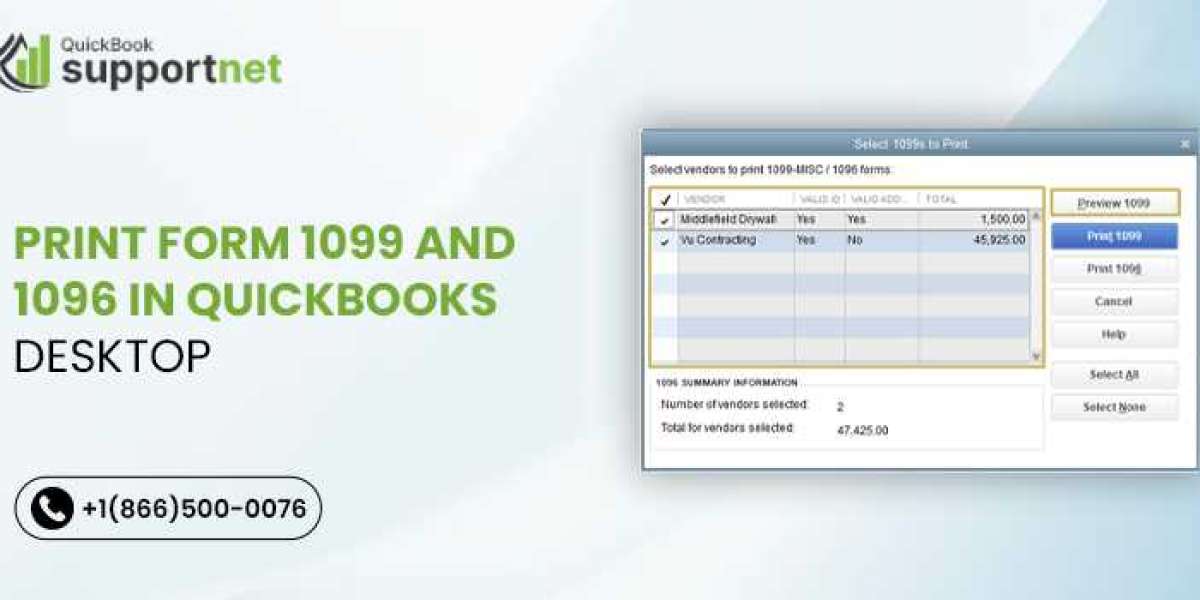

Step 2: Choose Vendors for 1099 Forms

Once your company data is ready:

- Navigate to Vendors Print/E-file 1099s.

- QuickBooks will list the vendors eligible for 1099 reporting:

- Check the payment amounts and confirm the correctness of the vendor details.

You can also make adjustments to boxes on the 1099 forms for reporting to ensure your forms are IRS-compliant.

Step 3: Printing Form 1099

Now, after verifying your vendor information, it is time to print the 1099 forms.

- Click Continue on the 1099 Wizard.

- Select Print 1099 Forms.

- Choose your printer and paper type. QuickBooks Desktop allows printing a 1099 on either pre-printed or blank forms.

Pro Tip: Always perform a test print first to avoid wasting paper and ensure alignment. This ensures the print of the 1099 form is correct according to IRS requirements.

Step 4: Printing Form 1096

Form 1096 summarizes all your 1099 submissions and is required when sending physical forms to the IRS. To print 1096 in QuickBooks Desktop:

- After printing the 1099 forms, the system will then prompt you to print 1096.

- Check the totals and confirm that all vendors have been accounted for.

- Click Print 1096 Form.

Ensure that your 1096 balances with the total amounts reflected in all the 1099s. This helps avoid IRS discrepancies and makes for smooth processing.

Tips for accurate printing

HOW TO AVOID COMMON MISTAKES WHEN PRINTING 1099 FORMS:

- Verify vendor TINs and addresses.

- Ensure that QuickBooks Desktop is updated to the latest release.

- If your printer is not aligned for blank forms, use compatible pre-printed 1099 forms.

- Keep a copy of all printed forms for record-keeping purposes.

Common Issues and Solutions

Even with careful preparation, you might experience the following problems when printing:

- Misaligned Forms: Adjust printer settings and test printing on plain paper first.

- Missing Vendor Information: Update the vendor's TIN, address, and payment information in QuickBooks Desktop.

- Form 1096: Check over all 1099 payments to make sure that the totals are correct.

For the recurring issues, you can call +1(866) 500-0076 to have the experts in QuickBooks to walk you through in real time.

Conclusion

Printing 1099 and 1096 forms using QuickBooks Desktop is very crucial for businesses to meet the IRS compliance without any errors. By following these steps and keeping your vendor information very accurate, you'll be able to generate and submit your forms in no time. Save time and reduce costly mistakes by keeping QuickBooks Desktop up to date and reviewing your 1099 data on a regular basis.

FAQs

Q1: Can I print 1099 forms on plain paper in QuickBooks Desktop?

Yes, QuickBooks Desktop allows you to print on plain or preprinted 1099 forms. Make sure your printer settings are right, and do a test print first.

Q2: How do I correct errors on a printed 1099 form?

If you find an error, correct the vendor information in QuickBooks and reprint the 1099 form. Do not send erroneous forms to the IRS.

Q3: Do I need to file Form 1096 if I e-file 1099 forms?

No, Form 1096 is only for physical submissions. For e-filing 1099s, no 1096 form is required.

Q4: Who should get a 1099?

A 1099 form is issued to independent contractors and vendors who were paid $600 or greater during the year.

Q5: How can I upgrade my QuickBooks for better form printing?

You can Upgrade QuickBooks 2023 to QuickBooks 2024 for better functionalities in printing and managing tax forms.