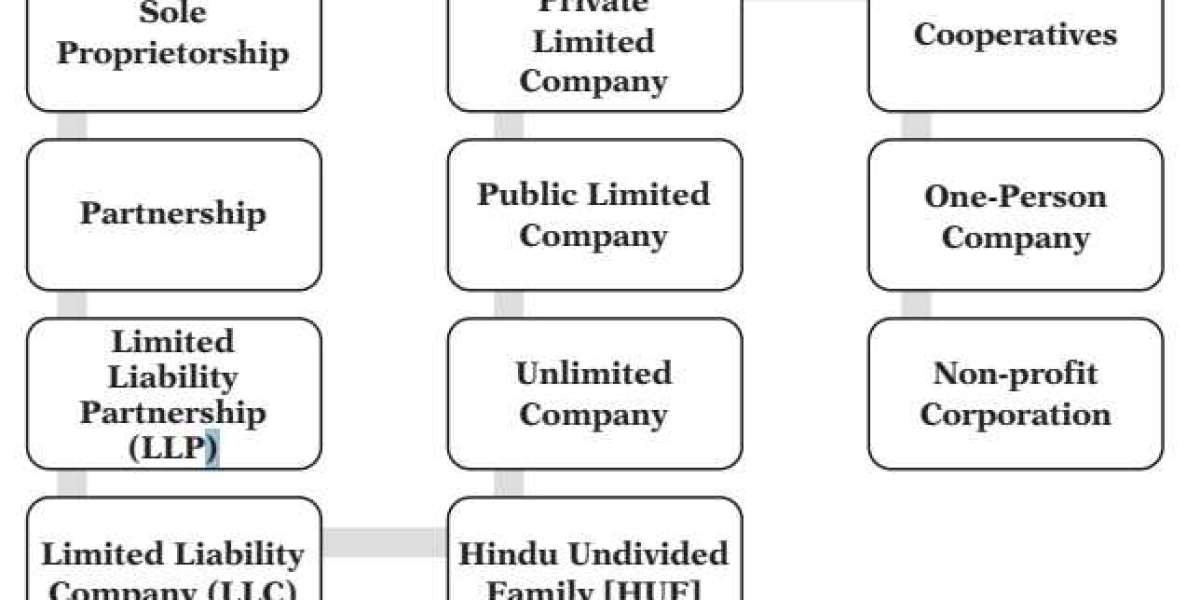

Starting a business in India is an exciting opportunity. One of the first steps to launching your business is to choose the right type of company registration. Each company type has its own set of benefits and requirements. In this article, we’ll discuss the most common types of company registration in India in simple terms.

1. Private Limited Company Registration

A Private Limited Company is one of the most popular types of company registration in India. This type of company is ideal for small and medium-sized businesses. It offers the benefit of limited liability, meaning that the personal assets of shareholders are protected if the company faces financial issues.

Features of Private Limited Company:

- Limited Liability: Shareholders are not personally responsible for the company's debts.

- Separate Legal Entity: The company is treated as a separate legal entity from its owners.

- Easy to Raise Funds: It is easier for private limited companies to raise funds compared to other business types.

If you’re interested in registering a Private Limited Company, you can find more details on our Private Limited Company Registration page.

2. Public Limited Company Registration

A Public Limited Company is a company that can offer its shares to the public. This is suitable for businesses that need to raise large amounts of capital. Public Limited Companies are required to follow strict guidelines and regulations as they are listed on stock exchanges.

Features of Public Limited Company:

- Unlimited Shareholders: A public limited company can have any number of shareholders.

- Public Offering: The company can offer its shares to the public on the stock market.

- High Compliance: There are more regulations and disclosure requirements compared to a private limited company.

To learn more about registering a Public Limited Company, visit our Public Limited Company Registration page.

3. Limited Liability Partnership (LLP) Registration

A Limited Liability Partnership (LLP) is a flexible business structure that combines the benefits of a partnership and a company. It is ideal for small businesses and startups. In an LLP, the partners have limited liability, meaning their personal assets are protected.

Features of LLP:

- Limited Liability: Partners are only liable to the extent of their investment in the business.

- Operational Flexibility: Unlike a company, there is no need for a formal board of directors.

- No Minimum Capital Requirement: LLPs do not need to maintain a minimum capital to start.

If you are considering registering an LLP, you can check more details on our LLP Registration page.

4. Section 8 Company Registration in India

A Section 8 Company is a non-profit company registered to promote activities like charity, education, art, or social welfare. These companies are formed under the Companies Act, 2013, and cannot distribute profits to their members. Instead, all income is used for the welfare of the community.

Features of Section 8 Company:

- Non-Profit Purpose: It is created for social causes and cannot distribute profits.

- Tax Exemption: Section 8 companies are eligible for various tax exemptions.

- Legal Status: The company has the legal status of a corporation, which enhances credibility.

To learn more about the process, visit our Section 8 Company Registration in India page.

5. One Person Company (OPC) Registration

A One Person Company (OPC) is a type of company where only one person can be the owner. It was introduced to help solo entrepreneurs enjoy the benefits of a company, such as limited liability, while being the sole owner.

Features of OPC:

- Single Ownership: Only one person owns and operates the business.

- Limited Liability: The owner’s personal assets are protected.

- Separate Legal Entity: OPC is treated as a separate legal entity from its owner.

If you want to start a business alone, check out our One Person Company Registration page.

6. Nidhi Company Registration in India

A Nidhi Company is a special type of company that aims to promote savings and mutual benefits among its members. It is a non-banking financial company (NBFC) that focuses on borrowing and lending money between its members.

Features of Nidhi Company:

- Mutual Benefit: It focuses on promoting savings and providing loans to members.

- Limited Liability: Shareholders have limited liability.

- Regulated by the Government: Nidhi companies are governed by the Ministry of Corporate Affairs (MCA).

If you are looking to register a Nidhi Company, you can find more information on our Nidhi Company Registration in India page.

Conclusion

Choosing the right type of company registration in India depends on various factors, including your business goals, the number of shareholders, and whether you need to raise capital. The options available range from a Private Limited Company for small businesses to a Public Limited Company for large enterprises looking to raise funds from the public. If you're a solo entrepreneur, you can also opt for an OPC.

FAQ: Types of Company Registration in India

1. What is the process for registering a Private Limited Company in India?

To register a Private Limited Company, you need to:

- Choose a unique company name.

- Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN) for the directors.

- Submit the required documents to the Ministry of Corporate Affairs (MCA).

- Once approved, you will receive the Certificate of Incorporation, making your company officially registered.

2. How many shareholders are required for a Public Limited Company?

A Public Limited Company requires a minimum of seven shareholders and three directors. There is no maximum limit on the number of shareholders, which is why public companies are suitable for raising large amounts of capital.

3. What are the benefits of registering a Limited Liability Partnership (LLP)?

The benefits of registering an LLP include:

- Limited Liability: Partners’ personal assets are protected, as they are not personally liable for the company’s debts.

- Operational Flexibility: LLPs do not need a formal board of directors, offering more flexibility in management.

- No Minimum Capital Requirement: There is no minimum capital required to start an LLP.

4. Can a Section 8 Company make a profit?

A Section 8 Company is a non-profit entity, which means it cannot distribute profits to its members or shareholders. Instead, any profit earned must be reinvested into the social or charitable cause the company was set up for.

5. What is the minimum number of members required to form a One Person Company (OPC)?

A One Person Company (OPC) requires only one member to start the company. This type of company is perfect for individuals who want to enjoy the benefits of limited liability while being the sole owner of the business.