Excellent Deal with Business Payroll Compliance Company in Ahmedabad

Why you need to follow the law to do business in India

People are at the heart of any business. No group can work without individuals. These people are the firm's workers, and they do different jobs to help the company reach its goals. A business has to be well-organized and run smoothly, with clear rules and conventions in place. These rules include everything, including how the corporation deals with its people and its money. This is what is called statutory compliance. Connect 2 Payroll Compliance Company Services in Ahmedabad India.

What does it mean to comply with the law?

According to Human Resources (payroll and taxes), statutory compliance is the set of laws that a corporation must follow when it comes to how it treats its workers.

Why is it vital to follow the law?

Statutory compliance has to do with the many labor and tax rules that are in place in India. Companies must follow these rules, which vary at both the state and national levels. If a corporation doesn't follow these rules, it might get into legal difficulties, such fines, penalties, or worse. This is why businesses put a lot of money into making sure they follow the law.

To stay up to date with any adjustments that need to be made, it is vital to have a good grasp of the different labor and tax laws in India. This is because the law is always changing and rules change all the time.

Is it different for batter enterprises when it comes to following the law?

No, it doesn't. The rules for following the law for a partnership firm, private limited company, LLP, or any other sort of business are mostly the same. Any business that hires people and pays them wages or salaries must follow labor rules when it comes to paying them, paying taxes, keeping them safe and protected, and treating them fairly.

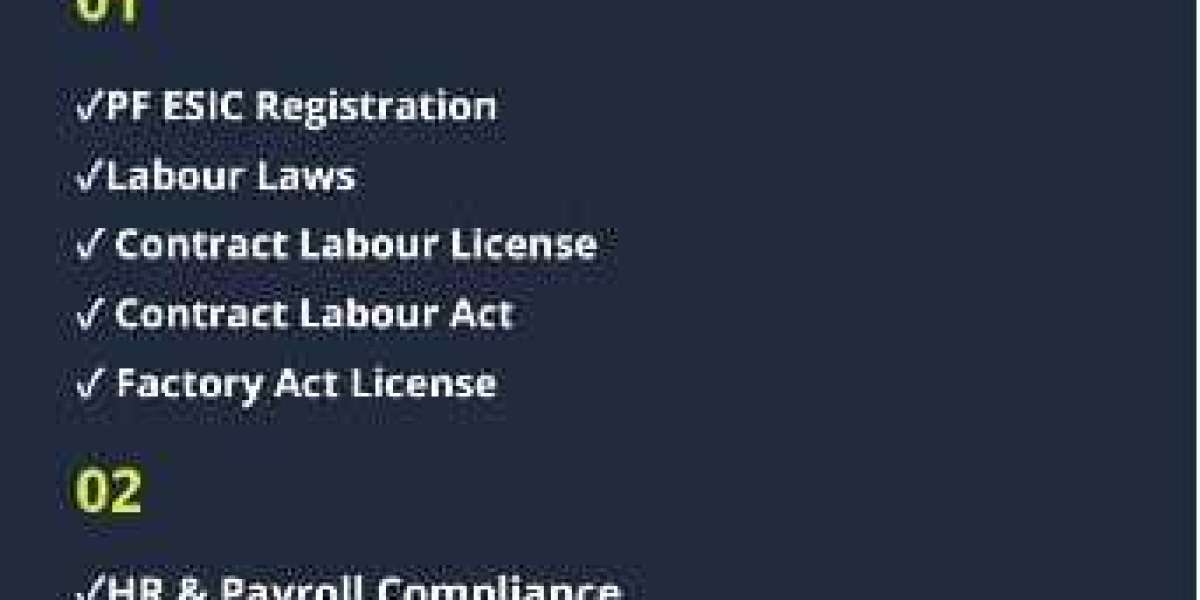

Some of India's labor laws that must be followed are as follows:

The 1923 Workmen's Compensation Act

The 1926 Trade Unions Act

The 1936 Payment of Wages Act

The 1946 Industrial Employment Standing Orders Act

The 1946 Industrial Disputes Act

The 1948 Employees' State Insurance Act

The 1948 Minimum Wages Act

The 1948 Factories Act

The Employees Provident Fund and Other Provisions Act of 1952

The Employment Exchanges (Compulsory Notification of Vacancies) Act of 1959

The 1961 Apprentices Act

The 1965 Payment of Bonus Act

The 1970 Contract Labour (Regulation Abolition) Act

The 1972 Payment of Gratuity Act

The 1976 Equal Remuneration Act

The Inter State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979.

The 1986 Child Labour (Prohibition Regulation Act)

Now let's talk about the tax obligations that businesses must pay attention to:

Keeping books of accounts that give a full and honest picture of the company's finances. These books must be kept up to date according to the rules of accounting, and a competent auditor or Chartered Accountant must check them.

Paying your advance taxes and TDS on time and filing your returns on schedule. This changes depending on the type of business.

Doing a statutory audit when the law says you have to.

All additional papers and documents needed to set up and register the business, among other things, must be in order.

Every business in India must follow all of these laws.

Making sure that the law is followed

It's hard to know every single labor and tax legislation and all the details of each one. What may be the answer to make sure that all laws are followed without any mistakes? A good system for managing payroll.

What does a payroll management system figure out?

When figuring up an employee's wage, how much tax should be taken off?

How much money an employee will take home after taxes and other deductions.

The payroll management system makes sure that both labor and tax laws are followed. It handles all the math for each employee once you provide all the necessary information. The system will take care of everything else as long as you make the necessary changes when they arise.

The Importance and Benefits of Following the Law

The best thing about Statutory Compliance for employees is that it makes sure that all workers are treated fairly. It stops workers from being taken advantage of or forced to work long hours or in bad circumstances. It also makes sure that people get paid properly for the work they do and that corporations follow the law about the minimum wage.

The benefit to businesses is that they pay their taxes on time, which keeps them out of a lot of legal issues, such as fines and penalties. It is easier for the government to collect taxes and for businesses to keep track of their money when there are clear laws. Following the law is vital to avoid getting into difficulties with the law. Depending on how bad the non-compliance is, companies might be penalized and/or taken to court.

In conclusion, it is very vital to follow the law and give it the right amount of thought. To make payroll management easier, businesses need to have the right system in place.