North America Sunflower Oil Price Analysis – Q1 2025

Sunflower Oil Prices in the United States:

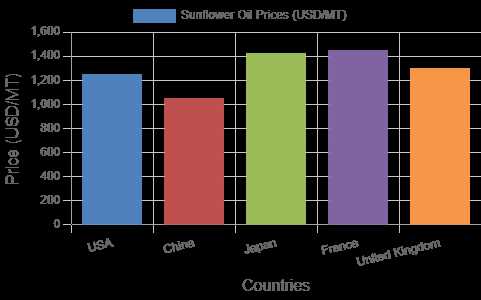

Product | Category | Price |

Sunflower Oil | Agricultural Feedstock | 1,250 USD/MT |

During Q1 2025, the Sunflower Oil Price Index in the USA exhibited significant volatility, with prices peaking at 1,250 USD/MT in March. Early in the quarter, reduced global seed production and strong competing oil markets drove prices upward, while limited acreage and robust export demand from Asia and Europe added further pressure. By late March, improved weather and cautious international buying led to a notable price correction, reflecting the dynamic Sunflower Oil Price Index.

Get the Real-Time Prices Report: https://www.imarcgroup.com/sunflower-oil-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

APAC Sunflower Oil Price Analysis – Q1 2025

Sunflower Oil Prices in China:

Product | Category | Price |

Sunflower Oil | Agricultural Feedstock | 1,050 USD/MT |

According to Sunflower Oil Price Historical Data, prices in China rose steadily to 1,050 USD/MT in Q1 2025. This increase was driven by Russian export restrictions limiting supply, higher freight costs raising import expenses, and strong domestic demand supported by government stimulus. Additionally, limited seed crushing capacity in key producing regions tightened supply further, sustaining the upward trend in the sunflower oil market throughout the quarter.

Sunflower Oil Prices in Japan:

Product | Category | Price |

Sunflower Oil | Agricultural Feedstock | 1,420 USD/MT |

During Q1 2025, the Sunflower Oil Price Index in Japan reflected persistent supply constraints and strong industrial demand, driving prices up to 1,420 USD/MT by March. Tight supplies from Eastern Europe, escalating procurement and freight costs, and robust domestic consumption all contributed to sustained upward momentum. These combined factors intensified market pressure and created a steady price appreciation throughout the quarter, as captured by the Sunflower Oil Price Trend Report.

Regional Analysis: The price analysis can be extended to provide detailed sunflower oil price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hong Kong, Singapore, Australia, and New Zealand, among other Asian countries.

Europe Sunflower Oil Price Analysis – Q1 2025

Sunflower Oil Prices in France:

Product | Category | Price |

Sunflower Oil | Agricultural Feedstock | 1071 USD/MT |

During Q1 2025, the Sunflower Oil Price Trend in France was marked by significant volatility, with prices reaching 1,450 USD/MT by March. This instability resulted from restricted import volumes and elevated production expenses across the supply chain. Global seed production uncertainties and export restrictions from major producing nations intensified fluctuations, while French processors faced rising input costs. Despite these challenges, steady demand from the food manufacturing and biofuel sectors maintained consistent consumption levels.

Sunflower Oil Prices in the United Kingdom:

Product | Category | Price |

Sunflower Oil | Agricultural Feedstock | 1,300 USD/MT |

During Q1 2025, the Sunflower Oil Price Index in the United Kingdom reflected pronounced volatility, with prices reaching 1,300 USD/MT in March. This fluctuation was driven by constrained global supply channels, elevated shipping expenses, and reduced shipments from Eastern European producers. Persistent currency instability further complicated procurement, yet domestic demand in foodservice and retail sectors remained strong, even as inventory levels steadily declined throughout the quarter.

Regional Analysis: The price analysis can be expanded to include detailed sunflower oil price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Key Factors Affecting Sunflower Oil Price Trend, Index, and Forecast

- Weather Crop Yields: Poor harvests from drought or frost reduce supply and raise prices.

- Geopolitical Events: Conflicts in major producing countries disrupt exports and cause volatility.

- Input Processing Costs: Higher costs for seeds, energy, and transport push prices up.

- Trade Policies: Export bans or tariffs impact global supply and pricing.

- Global Demand: Increased consumption, especially in Asia and Europe, supports higher prices.

- Rival Oil Prices: Changes in palm, soybean, or canola oil prices affect sunflower oil demand.

- Stock Levels: Low inventories keep prices high; surplus stocks can ease prices.

Forecast:

Sunflower oil prices are expected to remain volatile, shaped by weather-driven supply, geopolitical tensions, trade policies, and global demand trends. Improved harvests or easing geopolitical risks could stabilize prices, while ongoing disruptions or strong demand may sustain upward pressure. Regular monitoring of regional market dynamics and the sunflower oil price index is essential for accurate forecasting.

FAQs on Sunflower Oil Price Trend and Forecast (2025)

What is the current trend in sunflower oil prices globally in 2025?

Sunflower oil prices have shown significant volatility in 2025, with prices peaking in several regions due to supply constraints, high shipping costs, and strong demand, but are now moderating as supply conditions improve and demand softens in key markets.

How does the Sunflower Oil Price Index vary across major markets?

In Q1 2025, sunflower oil prices reached 1,250 USD/MT in the USA, 1,050 USD/MT in China, 1,420 USD/MT in Japan, 1,450 USD/MT in France, and 1,300 USD/MT in the United Kingdom, reflecting regional supply-demand dynamics and logistical challenges.

What are the main factors influencing the sunflower oil price trend in 2025?

Key drivers include global seed production levels, export restrictions from major producers, elevated freight and shipping costs, currency fluctuations, and shifting consumer demand, with weather and geopolitical events adding further pressure.

What is the forecast for sunflower oil prices in the coming months?

Analysts expect sunflower oil prices to remain under pressure but stabilize by mid-2025, with forecasts indicating prices may average around 1,327 USD/MT by the end of the current quarter and potentially rise to about 1,378 USD/MT over the next 12 months as market fundamentals rebalance.

How are shifts in demand and supply affecting the sunflower oil market outlook?

While some regions face declining consumption and oversupply, others—particularly in Asia—see upward price momentum due to limited imports and robust demand, suggesting that the global market will continue to experience localized volatility even as overall price levels stabilize.

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors Influencing Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Sunflower Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of Sunflower Oil price trend, offering key insights into global Sunflower Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlight major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Sunflower Oil demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By examining the intricate relationship between supply and demand, the prices report reveals key factors that influence current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, as well as pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145