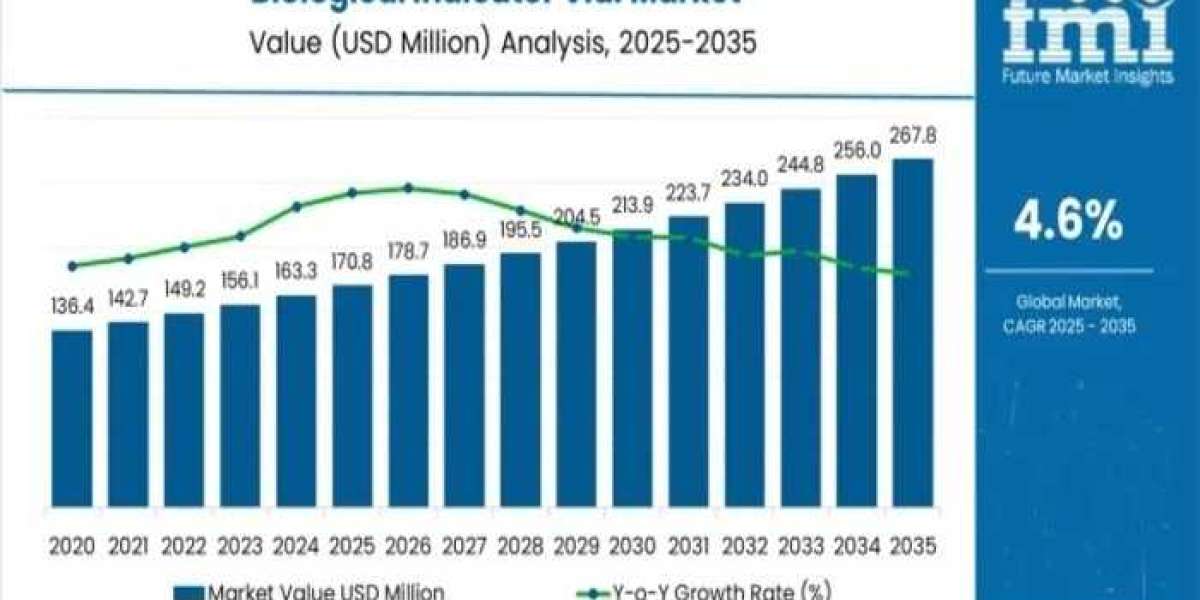

The global Biological Indicator Vial Market is entering a transformative decade—one defined by accelerated sterilization validation needs, tighter regulatory oversight, and the rapid emergence of next-generation biological monitoring technologies. Valued at USD 170.8 million in 2025, the market is forecast to reach USD 267.8 million by 2035, expanding at a 4.6% CAGR as industries strengthen contamination control, automate quality assurance, and adopt rapid-readout validation platforms at unprecedented scale.

A Decade of Transformation: Growth Outlook (2025–2035)

Over the next ten years, the market will add USD 97 million in new value, reshaping sterilization workflows across pharmaceuticals, food beverages, medical devices, and laboratory quality assurance.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates – https://www.futuremarketinsights.com/reports/sample/rep-gb-6240

2025–2030: The Acceleration Phase

The market is projected to grow from USD 170.8 million to USD 213.9 million, contributing 44% of total decade growth.

This period will see:

- Widespread adoption of rapid-readout biological indicators

- Rising regulatory pressure from FDA, ISO 11138, USP, and global GMP authorities

- Mass market acceptance of automated incubation systems and digitalized documentation

- Enhanced spore technology and quick-turnaround validation cycles becoming standard

2030–2035: The Optimization Phase

The second half of the forecast period pushes growth to USD 267.8 million, accounting for 56% of new revenue and marking the commercialization of:

- Self-contained biological indicators with integrated media

- Fully automated incubation platforms

- Cloud-connected reporting, audit trails, and electronic batch records

- High-volume deployment in pharmaceutical and food safety applications

Market Drivers and Structural Shifts

Key Growth Catalysts

- Regulatory stringency (FDA, ISO, pharmacopeial standards) requiring biological verification

- Food safety modernization (FSMA, HACCP) pushing validation in canning, retort, and aseptic lines

- Expansion of sterile manufacturing across biologics, injectables, and medical device packaging

- Growing demand for rapid-readout technologies with sub-24-hour results

Restraints

- Longer incubation cycles delaying batch release

- Budget limitations in emerging markets

- Need for specialized expertise in validation documentation

Pervasive Trends

- Fluorescence-based rapid indicators

- Self-contained vial formats reducing error risk

- Digital monitoring platforms with cloud connectivity

- Sustainability-focused product designs

Segmental Spotlight

By Sterilization Type

- Steam Sterilization leads with 57% share, driven by autoclave compatibility and strong regulatory acceptance.

- Ethylene Oxide Sterilization accounts for 43%, preferred for temperature-sensitive medical devices.

By Incubation Time

- 24–32 hours segment leads with 45% market share, balancing speed and accuracy.

- Up to 24 hours gains momentum for rapid-readout needs.

- Longer cycles (32–48 hours and 48 hours) sustain demand for traditional validation protocols.

By End Use

- Food Beverages dominate with 52% share, propelled by tightening global food safety regulations.

- Pharmaceuticals hold 28%, supported by sterile production growth.

- Cosmetics capture 20% through rising contamination prevention standards.

Regional Country-Level Outlook

High-Growth Markets

- China (6.2% CAGR) – Pharmaceutical capacity expansion, food safety modernization, and strong GMP enforcement

- India (5.8% CAGR) – Contract manufacturing surge, export-focused pharma, and affordable validation solutions

- South Korea (5.4% CAGR) – Biosimilar growth and K-FDA-driven aseptic validation requirements

Established Markets

- Germany (5.3% CAGR) – EU GMP leadership and advanced sterile manufacturing

- United States (4.4% CAGR) – FDA compliance culture and biologics manufacturing dominance

- United Kingdom (3.9% CAGR) – Strong biotech footprint and MHRA-regulated validation rigor

- Japan (3.5% CAGR) – Premium quality standards and high validation documentation requirements

Europe Market Overview

Europe will advance from USD 59.6 million in 2025 to USD 96.8 million by 2035, led by:

- Germany (36.2% share)

- United Kingdom (24.8%)

- France (18.4%)

- Italy (12.3%)

- Spain (8.3%)

Growing adoption in the Nordics and Eastern Europe supports additional expansion.

Competitive Landscape

The market is moderately consolidated, with the top 5 players controlling 60–65% revenue.

Key companies include:

VWR Corporation, STERIS plc., Mesa Labs, 3M Company, Siltex Australia

Where Competition Intensifies

- Rapid-readout systems

- Self-contained indicators

- Automated incubation digital reporting

- Regulatory compliance documentation

- Validation service packages

Emerging Opportunities

- Fluorescent rapid indicators

- Sustainable vial materials

- Subscription-based digital monitoring services

- Integrated sterilization validation ecosystems (indicator + incubator + documentation)

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.